Upward Rounding Move Pattern: A key bullish signal

The upward rounding move pattern is a significant price formation in technical analysis, often emerging after an extended downtrend and signaling a potential shift towards a new bullish phase. Recognizing and understanding the structure of the upward rounding move pattern can empower investors to identify promising trading opportunities and enhance their profit potential in the financial markets.

Contents

What is an upward rounding move pattern?

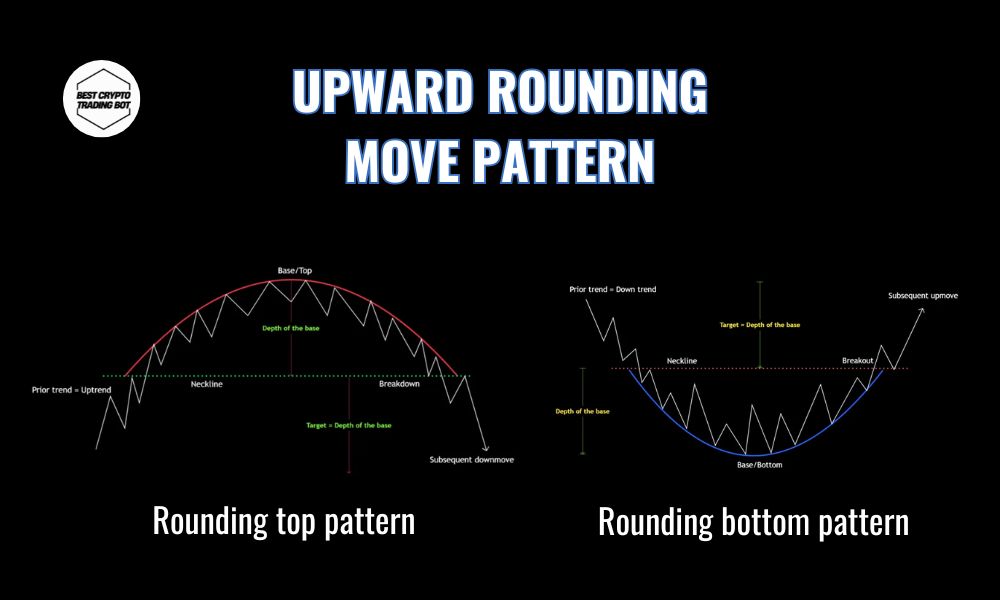

An upward rounding move pattern, also commonly known as a rounding bottom or saucer bottom, is a chart pattern in technical analysis. This pattern illustrates a gradual change in price trend, shifting from bearish to bullish, forming a curved shape resembling the bottom of a bowl or saucer. It is widely regarded as a potential bullish reversal signal, typically forming after a prolonged period of price decline and can take a considerable amount of time to complete.

The primary characteristic of an upward rounding move pattern is its smooth price action, devoid of sharp, sudden fluctuations. It reflects the gradual weakening of selling pressure and the slow, steady increase in buying pressure until the buyers eventually gain full control, pushing prices higher.

Identification characteristics

To accurately identify an upward rounding move pattern on a chart, traders should look for the following characteristics:

Prior trend: This pattern typically emerges after a distinct downtrend. The preceding decline can be long-term or short-term but must be significant enough to establish a bottoming area.

Rounding bottom shape: The most crucial part of the pattern is the curved, gently sloping bottom. Prices gradually decline to a low point, then slowly begin to rise again, forming a smooth curve. There should be no sharp, V-shaped movements during the base formation.

Trading volume: Volume plays a critical role in confirming the pattern.

- During the initial price decline, volume may be high.

- As prices start to form the base and move sideways, volume typically decreases, indicating the exhaustion of selling pressure.

- When prices begin to rise again and complete the right side of the curve, volume should increase, especially as the price breaks out above the neckline.

Neckline: This is a horizontal resistance level drawn across the highest peaks within the pattern’s formation, or the starting point of the downtrend before the bottom formed. A breakout above the neckline is a crucial confirmation signal.

Formation time: The upward rounding move pattern is often a long-term pattern, potentially taking several weeks, months, or even longer to fully form.

The psychological meaning behind the upward rounding move pattern

This pattern reflects a shift in market sentiment:

Downtrend phase: Sellers dominate, pushing prices down. Investors are pessimistic and may be liquidating positions.

Basing phase: Selling pressure begins to wane. Price movement slows and starts to trade sideways as some value investors begin to buy at lower prices (accumulation). The market is seeking a new equilibrium.

Uptrend phase: Investor confidence gradually returns. Buyers start to gain strength, pushing prices up slowly. When the price breaks the neckline, optimism spreads, attracting more buyers and confirming the new uptrend.

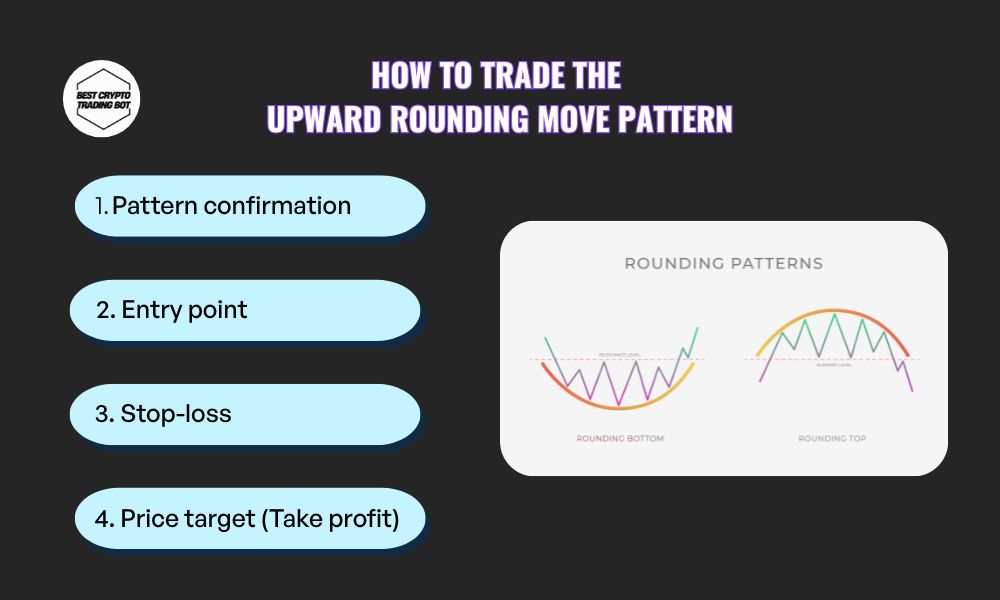

How to trade the upward rounding move pattern

- Pattern confirmation: Wait for the pattern to complete and for the price to break decisively above the neckline, ideally accompanied by a surge in trading volume.

- Entry point: Option 1 (More conservative): Buy when the price breaks out above the neckline. Option 2 (Riskier, higher potential reward): Buy when the price retests the neckline after the breakout (the neckline now acts as support).

- Stop-loss: Place a stop-loss order just below the neckline or below the most recent low within the curve of the pattern to limit risk if the signal proves false.

- Price target (Take profit):

- Common method: Measure the height from the lowest point of the rounding bottom to the neckline. Then, add this distance to the breakout point of the neckline to determine a potential price target.

- Use previous resistance levels or Fibonacci tools to identify other potential price targets.

Advantages and disadvantages

Advantages:

- A relatively reliable bullish reversal signal when properly confirmed.

- Provides a clear price target.

- Can offer a good risk/reward ratio.

Disadvantages:

- Long formation time, requiring patience from traders.

- Potential for false breakouts, especially without volume confirmation.

- The neckline can sometimes be challenging to define precisely.

Ultimately, the upward rounding move pattern provides vital bullish reversal signals. Understanding this pattern, combined with sound risk management, is key. Follow Best Crypto Trading Bot for deeper insights into the upward rounding move pattern and other trading strategies to enhance your investment journey. We are here to guide you.