What is Real-World Asset tokenization and how does it work?

Real-World Asset tokenization is emerging as a revolutionary force in finance and technology. Fundamentally, it is the process of converting ownership rights of physical or traditional financial assets into digital tokens on a blockchain platform, promising to unlock greater liquidity and accessibility for investors globally, thereby transforming how we interact with tangible value.

Contents

What is Real-World Asset tokenization?

Essentially, Real-World Asset tokenization is an innovative process that bridges the gap between tangible, valuable items in our physical world and the burgeoning digital landscape. Imagine you own something of worth, this could be a piece of real estate, a valuable painting, a bar of gold, or even less tangible assets like company stocks, bonds, or intellectual property rights such as music royalties.

These are all considered “Real-World Assets” or RWAs. The “tokenization” part of the term refers to the act of converting your ownership rights over such an asset into a unique digital certificate, known as a token, which is then securely recorded and managed on a blockchain. This blockchain acts like a transparent and unalterable public ledger.

Therefore, Real-World Asset tokenization effectively creates a digital representation, or a “digital twin,” of your real-world possession, allowing this ownership to be more easily bought, sold, divided into smaller, more accessible pieces, and managed with greater efficiency and transparency than traditional methods often allow.

How does Real-World Asset tokenization work?

The process of Real-World Asset tokenization typically involves several key steps:

- Asset selection and due diligence: The real-world asset must be carefully selected and thoroughly evaluated for its value, legal standing, and suitability for tokenization. This often requires the involvement of valuation experts and legal professionals.

- Legal structuring and compliance: A clear legal framework must be established to ensure that token ownership corresponds to ownership of the underlying real asset. This includes adherence to securities regulations, Anti-Money Laundering (AML), and Know Your Customer (KYC) requirements in relevant jurisdictions.

- Blockchain platform selection and token creation: The issuing entity will choose a suitable blockchain platform (e.g., Ethereum, Polygon, Solana) and create tokens representing the asset. Common token standards like ERC-20 (for fungible tokens) or ERC-721/ERC-1155 (for non-fungible tokens – NFTs) are often utilized.

- Token issuance and distribution: Once created, the tokens are issued and distributed to investors, often through platforms or via Initial Token Offerings (ITOs) or Security Token Offerings (STOs).

- Trading and management: These tokens can then be traded on secondary exchanges, providing liquidity to the underlying real asset. Management of the asset and associated cash flows (e.g., rental income from real estate, dividends from stocks) can also be handled through smart contracts.

Benefits of Real-World Asset tokenization

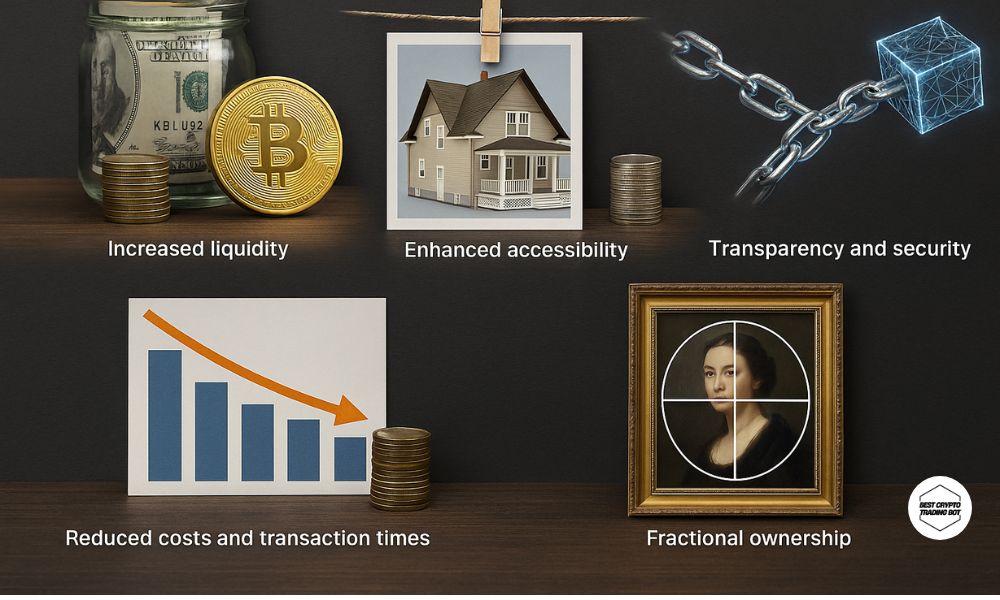

Real-World Asset tokenization offers numerous significant advantages:

Increased liquidity: Traditionally illiquid assets like real estate or fine art can be made more liquid. Tokenization allows these assets to be broken down into smaller, more easily tradable units on global, 24/7 markets.

Enhanced accessibility: By fractionalizing assets, Real-World Asset tokenization allows smaller retail investors to participate in high-value asset classes previously beyond their reach, thereby democratizing investment opportunities.

Transparency and security: Token transactions are recorded on a blockchain, ensuring transparency and immutability. Ownership is clearly recorded, minimizing risks of fraud and disputes.

Reduced costs and transaction times: Eliminating traditional intermediaries (like brokers and banks) and automating processes through smart contracts can significantly reduce transaction costs and settlement times.

Fractional ownership: Real-World Asset tokenization enables multiple individuals to co-own a single asset, each holding a fraction in the form of tokens.

Challenges and risks of Real-World Asset tokenization

Despite its immense benefits, Real-World Asset tokenization also faces several challenges:

- Regulatory uncertainty: This is a major hurdle. The lack of a unified and clear legal framework for tokenized assets in many countries creates uncertainty for investors and issuers.

- Valuation and asset backing issues: Accurately valuing real-world assets and ensuring that tokens are consistently and verifiably backed by these assets is challenging. Reliable auditing and custodial mechanisms are crucial.

- Technological security risks: While blockchain itself is secure, the platforms, smart contracts, and wallets used to store tokens can still be vulnerable to cyberattacks.

- Market adoption: Educating the market and building trust in tokenized assets requires time and sustained effort.

Common types of real-world assets being tokenized

Many types of real-world assets hold significant potential for Real-World Asset tokenization:

- Real estate: Fractionalizing ownership of buildings, apartments, and land.

- Art and collectibles: Allowing multiple investors to co-own high-value pieces.

- Commodities: Gold, oil, precious metals.

- Corporate stocks and bonds: Tokenizing traditional financial instruments.

- Private credit and loans: Opening up decentralized lending markets.

- Intellectual property: Music royalties, patents.

In summary, Real-World Asset tokenization links real assets to the digital world, revolutionizing finance with increased accessibility and efficiency. For deeper insights into this transformative Real-World Asset tokenization trend and other fintech developments, be sure to follow Best Crypto Trading Bot for continuous updates and expert analysis.